The "Million Income Backup Program" That Replaces Up To ₱10 Million of Lost Income When Accidents, Disabilities, Or Critical Illness Stops You From Working

Get Your Family Protected In The Next 7 Days or Less

Every Peso Returned If You Stay Healthy! 100% money-back guarantee at age 75

5x Your Income Paid Instantly, the moment critical illness or death happens

Wealth That Grows While You're Protected! Fast-track to 7-figure retirement funds

The "Million Income Backup Program" That Replaces Up To ₱10 Million of Lost Income When Accidents, Disabilities, Or Critical Illness Stops Your Ability To Work

Get Your Family Protected In The Next 7 Days or Less

Every Peso Returned If You Stay Healthy! 100% money-back guarantee at age 75

5x Your Income Paid Instantly, the moment critical illness or death happens

Wealth That Grows While You're Protected! Fast-track to 7-figure retirement funds

What would happen if you couldn't work tomorrow?

Could you still pay the bills?

The tuition fees?

Put food on the table for your family?

Maybe you have savings. 3 months? 6 months worth?

Here's the uncomfortable truth most breadwinners don't want to face:

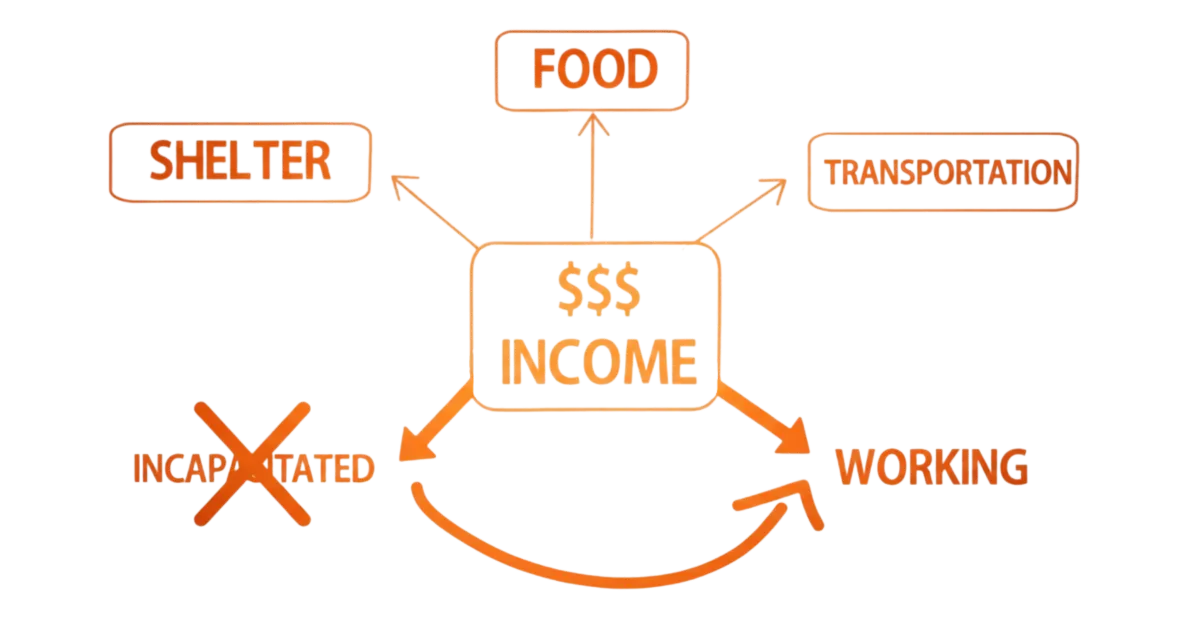

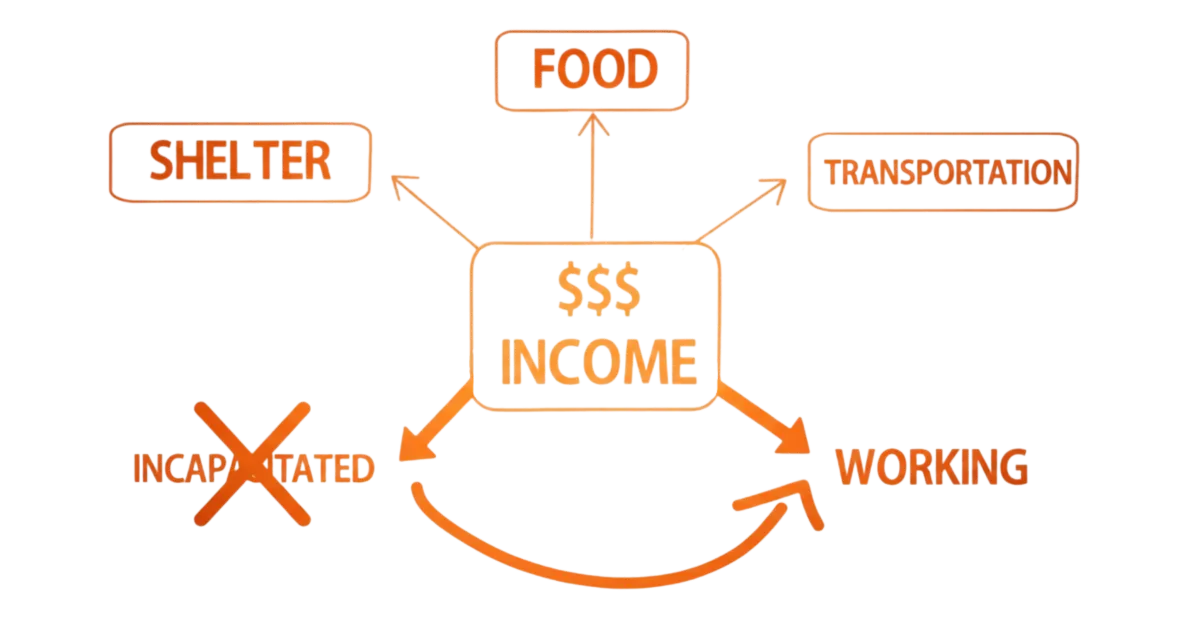

Everything In Your Life Runs On ONE Variable: Your Income

Your income decides the type of

food you eat.

Your income decides what kind of

clothes you wear

Your income decides what kind of

house you live in.

Right now, YOU are the only worker providing all of this.

There's no backup.

There’s no second income source.

There’s nobody there to help you when something happens.

So, What Happens When That Income Stops?

If you can't work tomorrow, whether from death, critical illness, disability, or retirement… everything stops.

Your loans and bills do not care.

School fees don't pause.

Your family's needs don't disappear.

That's why you need a "backup worker" That never stops and pays even when you can't.

What would happen if you couldn't work tomorrow?

Could you still pay the bills? The tuition fees?

Put food on the table for your family?

Maybe you have savings.

3 months? 6 months worth?

Here's the uncomfortable truth most breadwinners don't want to face:

Everything In Your Life Runs On

ONE Variable: Your Income

Your income decides the type of

food you eat.

Your income decides what kind of

clothes you wear

Your income decides what kind of

house you live in.

Right now, YOU are the only worker providing all of this.

There's no backup.

There’s no second income source.

There’s nobody there to help you when something happens.

So, What Happens When That Income Stops?

If you can't work tomorrow, whether from death, critical illness, disability, or retirement… everything stops.

Your loans and bills do not care.

School fees don't pause.

Your family's needs don't disappear.

That's why you need a "backup worker" that never stops and pays even when you can't..

The “Million Income Backup Program” That Takes Over When You Can't

Think of Income protection like this:

Worker #1: That's YOU, actively working and providing for your family today

Worker #2: That's YOUR FINANCIAL PLAN, ready to immediately take over when you can't work

Right now, most breadwinners only have Worker #1. And that's a single point of failure.

The “Million Income Backup Program” That Takes Over When You Can't

Think of Income protection like this:

Worker #1: That's YOU, actively working and providing for your family today

Worker #2: That's YOUR FINANCIAL PLAN, ready to immediately take over when you can't work

Right now, most breadwinners only have Worker #1. And that's a single point of failure.

If Your Paycheck Stopped Tomorrow, Where Would Your Next Income Come From?

Most breadwinners can't answer this. They hope nothing bad happens. They assume "someday" they'll figure it out.

That's the gap the "Million Income Backup Program" fills.

If Your Paycheck Stopped Tomorrow, Where Would Your Next Income Come From?

Most breadwinners can't answer this. They hope nothing bad happens. They assume "someday" they'll figure it out.

That's the gap the "Million Income Backup Program" fills.

The 4 Critical Life Events Every Breadwinner Must Plan For

You'll live a long life. But along the way, four unavoidable events will either secure your family's future… or destroy it.

Which will it be?

Event 1: Critical Illness

Cancer, heart attack, or stroke stops your income while medical bills pile up and drain savings fast.

Event 2: Children's Education

College costs ₱500K-₱2M+ per child and rises 10-15% yearly. Once you're gone, education funding disappears.

Event 3: Retirement

Your paycheck stops at 60-65, but bills continue. SSS/GSIS only covers basics, not your lifestyle.

Event 4: Death

Your income disappears forever, leaving your family to struggle with bills, debts, and lifestyle maintenance for years

If any of these happen tomorrow, is your family protected?

IF YOU WANT YOUR FAMILY SECURED NO MATTER WHAT! Are you tired of worrying what happens to your kids if something happens to you? Then this is for you.

IF YOU WANT PROTECTION WITHOUT WASTING MONEY! Are you frustrated by policies that cost thousands but give nothing back if you stay healthy? Then this is for you.

IF YOU WANT A INVESTMENT THAT GROWS WITH YOU! Have you wondered how much peace you'd feel knowing your coverage adapts as your income grows, without starting over or losing what you've built? Then this is for you.

The 4 Critical Life Events Every Breadwinner Must Plan For

You'll live a long life. But along the way, four unavoidable events will either secure your family's future… or destroy it.

Which will it be?

Event 1: Critical Illness

Cancer, heart attack, or stroke stops your income while medical bills pile up and drain savings fast.

Event 2: Children's Education

College costs ₱500K-₱2M+ per child and rises 10-15% yearly. Once you're gone, education funding disappears.

Event 3: Retirement

Your paycheck stops at 60-65, but bills continue. SSS/GSIS only covers basics, not your lifestyle.

Event 4: Death

Your income disappears forever, leaving your family to struggle with bills, debts, and lifestyle maintenance for years

If any of these happen tomorrow, is your family protected?

IF YOU WANT YOUR FAMILY SECURED NO MATTER WHAT! Are you tired of worrying what happens to your kids if something happens to you? Then this is for you.

IF YOU WANT PROTECTION WITHOUT WASTING MONEY! Are you frustrated by policies that cost thousands but give nothing back if you stay healthy? Then this is for you.

IF YOU WANT A INVESTMENT THAT GROWS WITH YOU! Have you wondered how much peace you'd feel knowing your coverage adapts as your income grows, without starting over or losing what you've built? Then this is for you.

“I Watched My Family Sell Everything To Pay Hospital Bills. Now I Make Sure That Never Happens To Yours”

My name is Charisse Geronimo.

Since 2023, I've been helping working professionals protect their families with the “Million Income Backup Program” that step in when life stops their income.

In fact, just last year, I helped one mother secure ₱3,000,000 in critical illness coverage for less than ₱160 per day (less than a price of a Starbucks’ coffee.)

When she was diagnosed with cancer 8 months later, that ₱3M coverage paid out immediately, AND her future premiums were completely waived. She got the money, stopped paying, and stayed fully protected while focusing on recovery.

I've uncovered the pathway to building the flexible income protection system that secures your family against death, illness, retirement, AND education, without breaking your budget or dealing with pushy advisors that leaves you when you need them the most.

You can use this "Million Income Backup Program" whether you're:

A breadwinner scared of what happens if you can't work

A parent worried about your kids' future

A professional tired of financial stress

I now help my clients build these income replacement plans through FREE personalized strategy call, showing exactly what coverage fits their life and budget. But after watching my own family struggle during my uncle's medical emergency, selling assets, lining up for charity, drowning in bills, I knew I had to share this system. Because I believe EVERY family deserves the peace of mind that comes with real protection.

There's just one catch… most people are buying insurance completely wrong, and it’s why so many families remain unprotected.

“I Watched My Family Sell Everything To Pay Hospital Bills. Now I Make Sure That Never Happens To Yours”

My name is Charisse Geronimo.

Since 2023, I've been helping working professionals protect their families with the “Million Income Backup Program” that step in when life stops their income.

In fact, just last year, I helped one mother secure ₱3,000,000 in critical illness coverage for less than ₱160 per day (less than a price of a Starbucks’ coffee.)

When she was diagnosed with cancer 8 months later, that ₱3M coverage paid out immediately, AND her future premiums were completely waived. She got the money, stopped paying, and stayed fully protected while focusing on recovery.

I've uncovered the pathway to building the flexible income protection system that secures your family against death, illness, retirement, AND education, without breaking your budget or dealing with pushy advisors that leaves you when you need them the most.

You can use this "Million Income Backup" program whether you're:

I now help my clients build these income replacement plans through FREE personalized strategy call, showing exactly what coverage fits their life and budget. But after watching my own family struggle during my uncle's medical emergency, selling assets, lining up for charity, drowning in bills, I knew I had to share this system.

Because I believe EVERY family deserves the peace of mind that comes with real protection.

There's just one catch… most people are buying insurance completely wrong, and it’s why so many families remain unprotected.

What Most Income Protection Plans Get Wrong…

….And Why Filipinos Waste ₱50,000+ Yearly On Coverage That Doesn't Protect Them

When I first started helping clients build solid financial planning, everyone followed the same bad advice from other financial advisors:

They're over-insured (paying for coverage they don't need)

They're under-insured (thinking they're protected when they're not)

They only cover death (leaving illness, retirement, and education unprotected)

But Here's What Most People Don't Know

There's a way to protect your family that:

Doesn't waste your money if you never claim it (100% money-back at age 75)

Covers ALL four threats to your income.

Starts with whatever budget you have TODAY (and grows with you)

Comes with a financial advisor who actually answers your messages

That's what I help you build.

Simple. Complete. Built for YOUR life.

What Most Income Protection Plans Get Wrong…

….And Why Filipinos Waste ₱50,000+ Yearly On Coverage That Doesn't Protect Them

When I first started helping clients build solid financial planning, everyone followed the same bad advice from other financial advisors:

They're over-insured (paying for coverage they don't need)

They're under-insured (thinking they're protected when they're not)

They only cover death (leaving illness, retirement, and education unprotected)

But Here's What Most People Don't Know

There's a way to protect your family that:

Doesn't waste your money if you never claim it (100% money-back at age 75)

Covers ALL four threats to your income.

Starts with whatever budget you have TODAY (and grows with you)

Comes with a financial advisor who actually answers your messages

That's what I help you build.

Simple. Complete.

Built for YOUR life.

Here’s How We Help Entrepreneurs & Employees

Become Financially Stress-Free Breadwinners

Problem You're Facing

"I'm terrified one medical emergency will bankrupt us"

"I don't know how much protection is enough"

"Every advisor I've met disappears after the sale"

"I can't afford to lose more money if I never use it"

"My income fluctuates, I can't commit to fixed payments"

"My retirement fund won't be enough"

"If something happens to me, my kids' education is gone"

How We Solve It

Get covered for major illnesses AND early-stage conditions: Claim up to 3x for different critical illnesses, so one diagnosis doesn't drain all your savings

Know exactly how much protection you need: Learn exactly how many years of income your family needs to maintain their lifestyle and eliminate guessing.

Partnership through thick and thin: We stay in touch throughout your journey, policy changes, claims support, life updates. You’re never left hanging.

Money-back protection guarantee: 100% of your investments returned at age 75 if you don't make major claims. Your family protected. Zero-waste on your investments.

Budget-friendly: We structure payments so you're never stressed about making them. Our payment plan aligns with your ACTUAL income pattern.

Savings for your Golden Years: Beyond immediate protection, we create plans that help you grow wealth for retirement, ensuring you're covered today while building for tomorrow.

Education Fund Protection: If critical illness or disability strikes, your premiums are waived, so your plan continues protecting your family AND their education goals stay on track.

The 3 Steps Million Income Backup Program That Show What You Need To Protect Your Income

Map Where Your Income

Stops Working

We’ll look at your current income and monthly obligations. Who depends on your paycheck. Your health history. Your retirement timeline and kids' education goals. Get a clear picture of where your income is vulnerable, and exactly how much protection you need to keep money flowing when life interrupts your paycheck.

Calculate What It Takes To Replace Your Income

We determine what it costs to replace your paycheck if you passed-away (5x annual income). What you need if critical illness stops your work (5x income). How much retirement and education will actually require.

Build Your Income

Protection Strategy

We map out: We design the coverage that fits today's budget. Flexible payment options that work with your cash flow. A growth plan as your income increases. Get the exact monthly investment required to protect your paycheck, and how to scale without restarting or losing coverage.

Here’s How We Help Entrepreneurs & Employees

Become Financially

Stress-Free Breadwinners

Problem You're Facing

"I'm terrified one medical emergency will bankrupt us"

"I don't know how much protection is enough"

"Every advisor I've met disappears after the sale"

"I can't afford to lose more money if I never use it"

"My income fluctuates, I can't commit to fixed payments"

"My retirement fund won't be enough"

"If something happens to me, my kids' education is gone"

How We Solve It

Get covered for major illnesses AND early-stage conditions: Claim up to 3x for different critical illnesses, so one diagnosis doesn't drain all your savings

Know exactly how much protection you need: Learn exactly how many years of income your family needs to maintain their lifestyle and eliminate guessing.

Partnership through thick and thin: We stay in touch throughout your journey, policy changes, claims support, life updates. You’re never left hanging.

Money-back protection guarantee: 100% of your investments returned at age 75 if you don't make major claims. Your family protected. Zero-waste on your investments.

Budget-friendly: We structure payments so you're never stressed about making them. Our payment plan aligns with your ACTUAL income pattern.

Savings for your Golden Years: Beyond immediate protection, we create plans that help you grow wealth for retirement, ensuring you're covered today while building for tomorrow.

Education Fund Protection: If critical illness or disability strikes, your premiums are waived, so your plan continues protecting your family AND their education goals stay on track.

The 3 Steps Million Income Backup Program That Show What You Need To Protect Your Income

Map Where Your Income

Stops Working

We’ll look at your current income and monthly obligations. Who depends on your paycheck. Your health history. Your retirement timeline and kids' education goals. Get a clear picture of where your income is vulnerable, and exactly how much protection you need to keep money flowing

when life interrupts your paycheck.

Calculate What It Takes

To Replace Your Income

We determine what it costs to replace your

paycheck if you passed-away (5x annual income).

What you need if critical illness stops your work

(5x income). How much retirement and education will actually require.

Build Your Income Protection Strategy

We map out: We design the coverage that fits today's budget. Flexible payment options that work with your cash flow. A growth plan as your income increases. Get the exact monthly investment

required to protect your paycheck, and how to

scale without restarting or losing coverage.

During Your FREE Strategy Call, You'll Discover:

The "Zero Waste" Investment

Why most people think their premiums are wasted money, and how the money-back guarantee changes everything (even if you never get sick).

The Protection Priority Framework

The exact order to build your family's safety net when money is tight.

The Real Cost vs. Real Coverage Breakdown

How to translate your daily expenses into millions in protection.

The Pre-Existing Condition Strategy

If you have health issues, I'll show you exactly how to navigate the approval process, so you don't waste time or money on dead-end applications.

The 2-Year Fast-Track Investment

How to 5x-10x your wealth in a 2-year plan while staying protected, build 7-figure retirement funds, AND cover your family in one plan.

During Your FREE Strategy Call, You'll Discover:

The "Zero Waste" Investment

Why most people think their premiums are wasted money, and how the money-back guarantee changes everything (even if you never get sick).

The Protection Priority Framework

The exact order to build your family's safety net when money is tight.

The Real Cost vs. Real Coverage Breakdown

How to translate your daily expenses into millions in protection.

The Pre-Existing Condition Strategy

If you have health issues, I'll show you exactly how to navigate the approval process, so you don't waste time or

money on dead-end applications.

The 2-Year Fast-Track Investment

How to 5x-10x your wealth in a 2-year plan while staying protected, build 7-figure retirement funds, AND cover your family

in one plan.

Here’s What Our Clients Are Saying

"Thank you, Ms. Charisse, for helping me find the perfect insurance that suits my lifestyle. Now, I have peace of mind knowing that no matter what happens, I’m covered with comprehensive health insurance while also building my retirement fund. Kudos to you!."

Miguel R.

34, Business Owner

"Miss Cha helped me track my finances and find the right allocation for my income. Not only did I start my insurance plan, but I also discovered how to enjoy my earnings the right way—smart and stress-free!"

Anna Marie T.

38, Manager

"No pressure—just pure education. Mabait is Ma’am Cha. Tinuruan nya akong mag-budget at madali kong natutunan. Maliit lang ang sweldo ko pero nakakapagtabi na ako para sa emergency fund ko. Soon, makapagstart na ako ng health insurance ko. Salamat, Ma’am Cha!"

Carlo M.

31, IT Professional

Here’s What Our Clients Are Saying

"Thank you, Ms. Charisse, for helping me find the perfect insurance that suits my lifestyle. Now, I have peace of mind knowing that no matter what happens, I’m covered with comprehensive health insurance while also building my retirement fund. Kudos to you!."

Miguel R.

34, Business Owner

"Miss Cha helped me track my finances and find the right allocation for my income. Not only did I start my insurance plan, but I also discovered how to enjoy my earnings the right way—smart and stress-free!"

Anna Marie T.

38, Manager

"No pressure—just pure education. Mabait is Ma’am Cha. Tinuruan nya akong mag-budget at madali kong natutunan. Maliit lang ang sweldo ko pero nakakapagtabi na ako para sa emergency fund ko. Soon, makapagstart na ako ng health insurance ko. Salamat, Ma’am Cha!"

Carlo M.

31, IT Professional

FWD STATS

Here’s How We Made A Difference In Our Client’s Lives

Disclaimer: This data shows the claims we paid during the period of January 1 to December 31, 2024

300 Death Claims Paid

PHP 427,621,434 paid

Helping families move forward without financial stress

105 Critical Illness Paid

PHP 55,726,564 paid

Supporting you in your recovery so you can focus on getting better

197 Hospital And Cash Benefits Claims

Paid PHP 2,061,000 paid

Supporting you daily as you heal, so you can rest, recover, and return stronger.

FWD STATS

Here’s How We Made A Difference In Our Client’s Lives

Disclaimer: This data shows the claims we paid during the period of January 1 to December 31, 2024

300 Death Claims Paid

PHP 427,621,434 paid

Helping families move forward without financial stress

105 Critical Illness Paid

PHP 55,726,564 paid

Supporting you in your recovery so you can focus on getting better

197 Hospital And Cash Benefits Claims

Paid PHP 2,061,000 paid

Supporting you daily as you heal, so you can rest, recover, and return stronger.

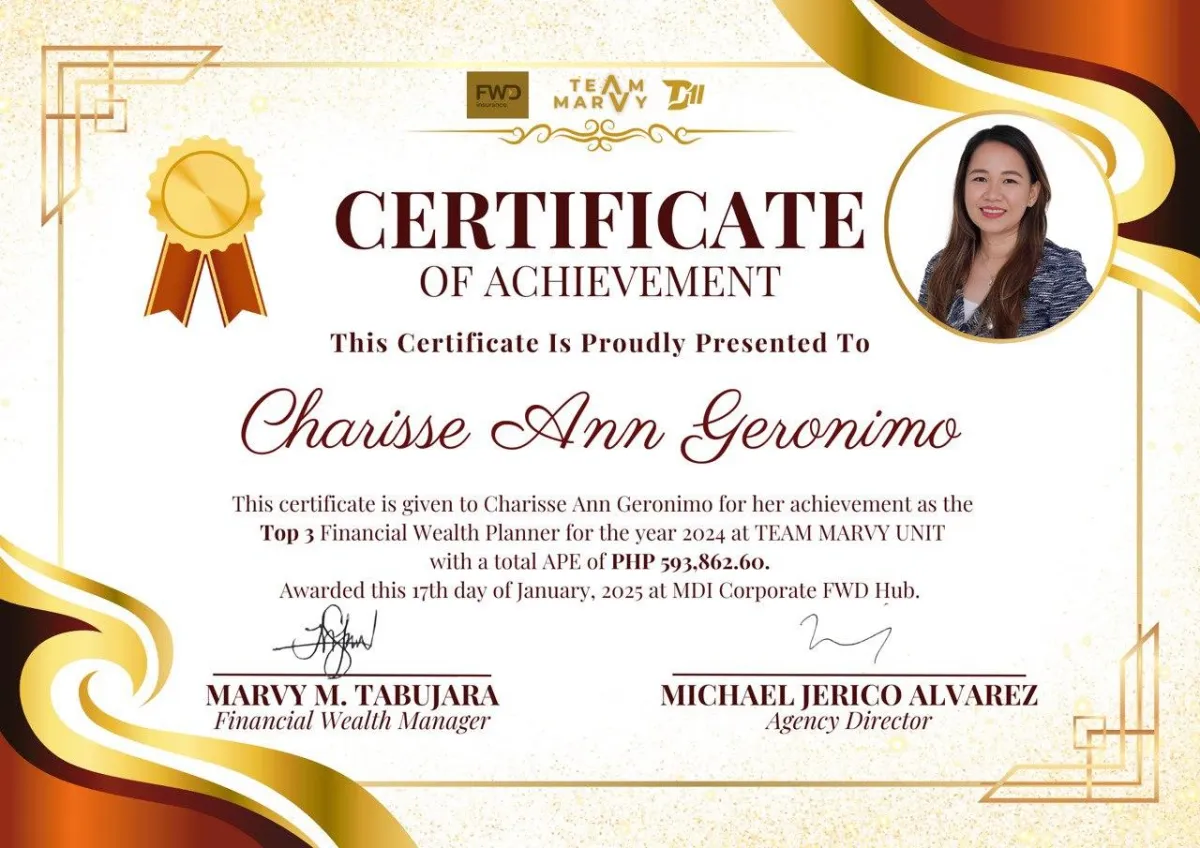

Credentials & Recognition

2025 Achievements

2024 Performance

Credentials & Recognition

2025 Achievements

2024 Performance

Tomorrow, When You Sit Down To Your Desk For Work…

Will You Still Be Carrying That Financial Stress With You?

If you're like most breadwinners, you're still "planning to plan." And the truth is, you can stay exactly where you are and hope no emergencies happen (fingers crossed):

You stay healthy long enough to get approved later

Premiums don't increase too much by then

Your company insurance is somehow enough

Your family will figure it out if something happens

Or, you can secure your family’s lifestyle and do what needs to be done today.

Book a call. In 30 minutes, get clarity on:

Exactly how much coverage your family needs

What it actually costs

Which coverage fit YOUR lifestyle and budget

How to prioritize protection with limited funds

After this important call, you could:

Finally understand what you need

See your personalized protection roadmap

Know exactly what happens if you wait vs act now

Make an informed decision that your family will surely thank you.

The choice is yours.

But you've read this far because you know something has to change. Now it's just a matter of taking the next step.

Tomorrow, When You Sit Down To Your Desk For Work… Will You Still Be Carrying That Financial Stress With You?

If you're like most breadwinners, you're still "planning to plan." And the truth is, you can stay exactly where you are and hope no emergencies happen (fingers crossed):

You stay healthy long enough to get approved later

Premiums don't increase too much by then

Your company insurance is somehow enough

Your family will figure it out if something happens

Or, you can secure your family’s lifestyle and do what needs to be done today.

Book a call. In 30 minutes, get clarity on:

Exactly how much coverage your family needs

What it actually costs

Which coverage fit YOUR lifestyle and budget

How to prioritize protection with limited funds

After this important call, you could:

Finally understand what you need

See your personalized protection roadmap

Know exactly what happens if you wait vs act now

Make an informed decision that your family will surely thank you.